I. Executive Summary

1.1 Introduction

Technology has revolutionized personal finance, empowering individuals with enhanced access, convenience, and knowledge. Traditional approaches are disrupted as digital tools provide unprecedented opportunities to manage finances. From personalized advice to seamless transactions, technology has transformed how people engage with their financial well-being, making informed decisions and achieving goals efficiently.

[Company Name] will act as an all-in-one platform and will provide personal financial management services to individuals, small business owners, and entrepreneurs through its cutting-edge and award-winning technology. The Company seeks to provide a comprehensive financial management solution that simplifies the complexities of running a business and empowers entrepreneurs to make informed decisions, streamline operations, and drive growth. Whether it's tracking expenses, managing business accounts, or generating financial reports, the platform is designed to support the financial needs of individuals, families, and small businesses and enable them to achieve their goals.

The Company, located at [insert location here], will be a leading personal finance management solution provider that will meet the needs of professionals, families, and individuals with diverse financial goals, ranging from budgeting and expense tracking to investment management and retirement planning. Ultimately, the company will provide a comprehensive and user-friendly personal finance solution that will offer specialized tools and features tailored to meet the unique needs of small businesses, such as accounting integrations, invoicing capabilities, and cash flow management, while providing them with a highly convenient user interface.

1.2 Founder Information

[Company Name] will be led by [Founder’s name], a highly skilled and accomplished entrepreneur with over [xx] years of experience in business leadership and development. His expertise encompasses all aspects of business formation, operational excellence, finance, and management.

1.3 Target Customer

The Company will develop both standard and customized software for its target audience according to their needs and demands. The Company’s major target customers include-

1.4 Why Us

Holistic Financial Aggregation–The Company’s personal finance management solution will offer a holistic approach to financial aggregation, allowing users to securely link and manage multiple accounts across various financial institutions. This provides users with a comprehensive view of their financial landscape, including bank accounts, credit cards, investments, loans, and more, all in one centralized platform.

Intelligent Expense Tracking – With advanced expense tracking features, users can effortlessly categorize and analyze their expenses in real time. The solution will leverage machine learning algorithms to automatically classify transactions, providing valuable insights into spending patterns, budget management, and opportunities for savings.

Goal-based Financial Planning –The platform will enable users to set and track their financial goals, whether it's saving for a down payment, paying off debt, or planning for retirement. Through intuitive interfaces and personalized recommendations, users can develop actionable strategies, monitor progress, and make informed decisions to achieve their financial objectives.

Smart Budgeting Tools –The Company will offer robust budgeting tools that empower users to create personalized budgets based on their income, expenses, and financial goals. The solution also provides real-time budget tracking, alerts for overspending, and visualizations to help users stay on top of their finances and maintain financial discipline.

Investment Management –The Company’s personal finance management solution will go beyond day-to-day finances by offering investment management features. Users can access market insights, track investment performance, and make informed investment decisions, all within the same platform. This integration simplifies the process of managing investments and aligns financial planning with long-term wealth-building strategies.

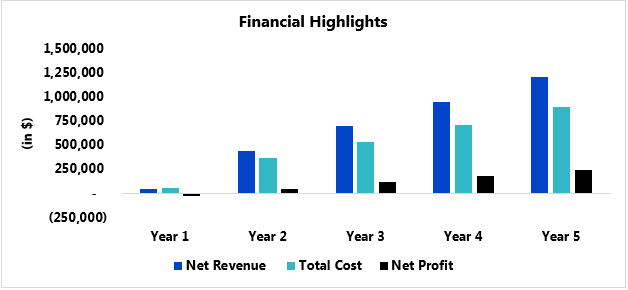

1.5 Financial Highlights