V. Competitive Analysis

5.1 Competitors

Competitor 1

[Competitor 1] is a renowned and trusted personal finance management solution provider offering robust fraud detection and prevention measures. The company prioritizes the security of users' financial data and implements advanced encryption techniques to ensure data privacy and protection. Its platform provides a seamless and user-friendly interface, empowering individuals to take control of their finances effectively.

Competitor 2

With [Competitor 2]'s personal finance management solution, users can seamlessly track their expenses, monitor budgets, and gain valuable insights into their financial health. The platform offers intuitive tools for categorizing transactions, generating customized reports, and visualizing spending patterns, empowering users to make informed financial decisions.

Competitor 3

[Competitor 3] offers a comprehensive personal finance management solution tailored to meet the diverse needs of individuals seeking effective financial management. The platform provides a range of services and features designed to simplify personal finance tasks and empower users to take control of their financial lives.

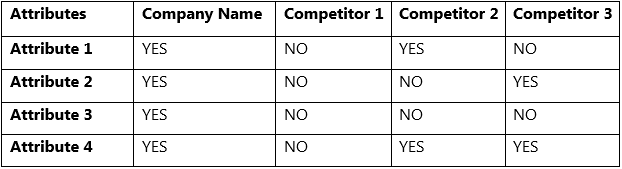

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Comprehensive platform and customizable software

- Integrated budgeting and expense-tracking tools

- Robust security measures

Weakness

- Being new to the industry could lead to a significant lag in establishing goodwill and trust.

Opportunities

- The personal finance management industry is witnessing significant growth as more individuals recognize the importance of financial management and seek digital solutions.

- The personal finance software market is anticipated to experience significant growth from $1.7 billion in 2023 to $2.2 billion by 2027, with a compound annual growth rate (CAGR) of over 6%.

Threats

- Competitors could look to copy the company’s business model.