V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 is a high-end Crypto ATM service provider with a network of 80 crypto ATMs across the US. It provides 15+ digital currencies to its users in exchange for cash payments, debit and credit card payments, and other traditional payment options. Competitor 1 has also developed a smooth process for the initial sign-up. Moreover, it has a mobile platform that displays all the transaction records of users, with a digital wallet for storing the cryptocurrencies.

Competitor 2

Competitor 2 is one of the most trusted names in the Crypto ATM sector. Its features provide facilities like buying 100 different types of cryptocurrencies, buying and selling Bitcoin instantly using cash, lightning-fast Bitcoin transactions, finding a Bitcoin ATM location, etc.

Competitor 3

Competitor 3 was established in [xx]. It is a customer-oriented Crypto ATM services company that provides simplified, secure access to the cryptocurrency world. Given the rapidly evolving fintech industry, Competitor 3 has focused deeply on developing world-class compliance and consumer protection program, multi-tier high-touch support, and a service that supports millions of unbanked and underbanked citizens. Competitor 3 has limited payment options for the withdrawal and submission of cryptocurrency credit and debit card payments and cash payments.

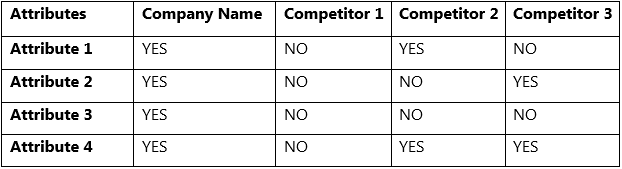

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Multiple payment options like Cash Payment, Wire Transfer, Account Transfer, credit card, and debit card.

- Provide a crypto wallet for storing and managing Bitcoin, Bitcoin Cash, Ethereum, and Stablecoins.

- Personalized shopping experiences clubbed with lucrative offers.

- 24/7 customer support for technical guidance and assistance.

Weakness

- Being new in the crypto sector could lead to a significant lag in making goodwill and trust.

Opportunities

- The global Crypto ATM market size was valued at $35.8 million in 2020 and is projected to reach $3.5 billion by 2030, growing at a CAGR of 58.5% from 2021 to 2030.14

- In May 2021, Bitcoin Depot announced the launch of over 350 new cryptocurrency ATMs opening across the US.15

Threats

- Competitors could look to copy the company’s business model.

15.https://www.prnewswire.com/news-releases/cryptocurrency-atm-market-size-to-grow-by-usd-2-37-billion--north-america-to-notice-maximum-growth--technavio-301553885.html