I. Executive Summary

1.1 Introduction

The financial industry is experiencing a revolution in fintech lending, driven by technological advancements and novel approaches to accessing financial services. This shift is paving the way for significant changes in the loan market. Digital lenders are leveraging state-of-the-art AI and data analytics technology to disrupt the traditional lending landscape. In order to remain competitive in this technology-driven market, traditional lenders need to gain a deeper understanding of fintech lending and adapt accordingly.

[Company Name] intends to offer a fintech lending and finance platform that will provide businesses and individuals with a convenient and efficient way to access various financial products and services, including loans, credit lines, investment opportunities, and other financial tools. The platform will bridge the gap between borrowers and traditional financial institutions by providing access to finance for individuals and businesses that may have difficulty obtaining loans through traditional channels. These platforms often leverage alternative data sources and scoring models to assess creditworthiness, enabling financial inclusion for underserved populations. Moreover, the platform will utilize advanced data analytics and algorithms to make informed lending decisions. By analyzing various data points, they can assess risk more accurately and make data-driven lending decisions, resulting in improved loan performance and reduced default rates.

The Company will empower individuals and businesses by providing access to finance, enhancing the customer experience, and promoting financial inclusion through a streamlined and user-friendly digital platform, eliminating the need for extensive paperwork and time-consuming processes associated with traditional lending.

1.2 Founder Information

[Company Name] is spearheaded by [Founder's Name], a seasoned professional with a wealth of [xx] years of expertise in the fintech industry. With a proven track record, [Founder] has successfully served as a manager at a prominent fintech firm, showcasing exceptional managerial skills during the tenure.

1.3 Target Customer

[Company Name] is in a fintech business that will cater to Small and Medium-sized Enterprises, underbanked or underserved populations, as well as individual consumers who require personal loans, credit, or alternative financing options.

1.4 Why Us

Faster Loan Approval and Disbursement–Traditional loan processes typically involve lengthy approval times, requiring multiple rounds of documentation and manual verification. The Company's fintech lending and finance platform will leverage automation and data-driven algorithms to assess risk and process loan applications quickly, thus allowing for faster loan approvals and disbursements, addressing urgent financial needs.

Data-Driven Decision Making – The Company's fintech lending and finance platform will utilize advanced data analytics and algorithms to make informed lending decisions. By analyzing various data points, the platform will assess risk more accurately and make data-driven lending decisions, resulting in improved loan performance and reduced default rates.

Financial Inclusion –The platform will play a crucial role in promoting financial inclusion by serving individuals and SMEs that have limited access to traditional financial services. The platform will leverage technology and alternative data to assess creditworthiness, allowing it to reach underserved populations and extend financial opportunities to those who might otherwise be excluded.

Integration with Other Financial Services –The Company's platform can be integrated with other financial services, such as payment systems, budgeting tools, or investment platforms, providing users with a comprehensive financial ecosystem. This integration will enable users to manage their finances more efficiently and access multiple financial services from a single platform.

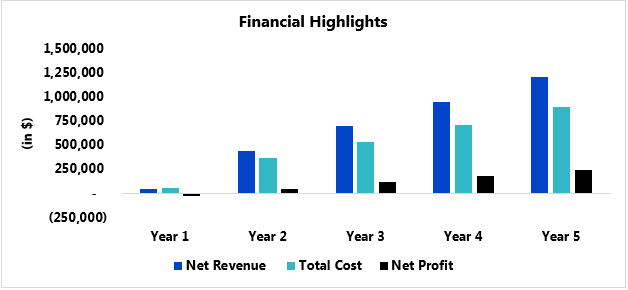

1.5 Financial Highlights