V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 is an online marketplace connecting borrowers with investors. It offers personal loans, business loans, and auto refinancing options through its platform. Competitor 1 utilizes technology to simplify the lending process, assess borrower creditworthiness, and match borrowers with suitable loan options.

Competitor 2

Competitor 2 is a digital personal finance company. It allows members to borrow, save, spend, invest, and protect their money. The company has developed a financial services platform to offer products to members and meet their financial needs. Competitor 2 operates through three segments: lending, financial services, and a technology platform. Its Lending segment offers multiple loan products, such as home loans, student loans, and personal loans.

Competitor 3

Competitor 3 offers a range of lending and financial services, including personal loans, student loan refinancing, mortgages, and investment products. It leverages technology to provide a streamlined and user-friendly borrowing experience, along with various member benefits and financial planning tools.

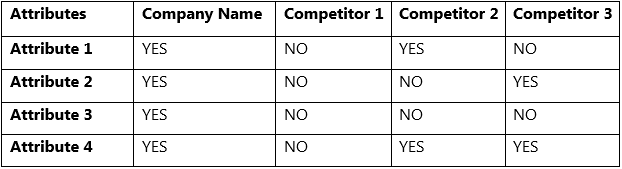

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Offering a more accessible, efficient, and personalized financial experience, revolutionizing the way individuals and businesses access and manage their finances.

- Mobile accessibility that will help enhance convenience and enable users to stay connected to their finances on the go.

- Integrable with other financial services and applications, such as payment systems, budgeting tools, and credit monitoring services, to provide users with a comprehensive financial ecosystem.

- Robust security measures and fraud prevention protocols, instilling customer confidence in the safety and protection of their financial data.

Weakness

- Being new to the industry could lead to a significant lag in establishing goodwill and trust

- Navigation and compliance with evolving regulatory frameworks and ensure adherence to data protection and privacy regulations, which may pose challenges and additional costs.

Opportunities

- The fintech lending market is experiencing a significant surge in the consumer lending segment, driven by various factors, including the growing consumer appetite for credit, the widespread adoption of digital platforms and online lending services, advancements in data analytics and credit scoring models, as well as evolving consumer preferences towards digital and mobile banking.

Threats

- Competitors could look to copy the company's business model.

- Rapid advancements in technology and changing customer preferences.