I. Executive Summary

1.1 Introduction

The insurance industry is undergoing a transformation due to the fintech revolution, which is disrupting traditional models and providing new opportunities for growth and innovation. The rise of the insurance sector is driven by changing consumer behavior, which seeks seamless and effective access to the right insurance products. Innovative startups are leading the charge in redefining the customer experience through solutions such as risk-free underwriting, on-the-spot purchasing, activation, and claims processing. They are also exploring new avenues such as ultra-customized policies, social insurance, and the use of advanced technologies to dynamically assess price premiums based on observed behavior.

[Company Name] will develop an advanced mobile app and online platform to offer innovative insurance products and services. By leveraging cutting-edge technologies like AI, machine learning, blockchain, and data analytics, the insurance underwriting process will be streamlined, resulting in personalized and convenient insurance solutions that meet customers' unique needs with flexibility and convenience. Using technology, the company will reduce costs, improve risk management and fraud prevention, and create a more efficient insurance process, enabling previously underserved markets, such as low-income customers as well as emerging markets, to have better access to insurance coverage.

The Company will be located at [insert location here], making insurance more accessible and efficient for everyone.

1.2 Founder Information

[Company Name] will be led by [Founder's name], a visionary leader and an experienced professional who has xx years of experience working in the finance and insurance sectors. With a passion for technology, [Founder's name] seeks to disrupt as well as modernize the insurance industry through its technology-enabled innovative solutions.

1.3 Target Customers

[Company Name] will target digital natives, small business owners, underinsured/uninsured individuals, and high-risk individuals. The Company aims to provide tailored solutions to meet the unique insurance needs of these groups.

1.4 Why Us

1. Innovative Solutions-The Company will offer solutions that are designed to meet the needs of customers in a fast, convenient, and efficient manner. With the use of advanced technologies, the company will provide a better user experience and offer personalized products and services.

2. Competitive Pricing – The Company will offer competitive pricing due to the company’s efficient operations and use of advanced technologies. Customers can benefit from lower premiums and fees, which can lead to significant savings over time.

3. Flexibility –The Company will offer more flexibility as customers can choose from a range of policies that are tailored to their individual needs rather than being limited to a one-size-fits-all approach. This flexibility allows customers to select the coverage that is right for them, which can lead to better outcomes and higher customer satisfaction.

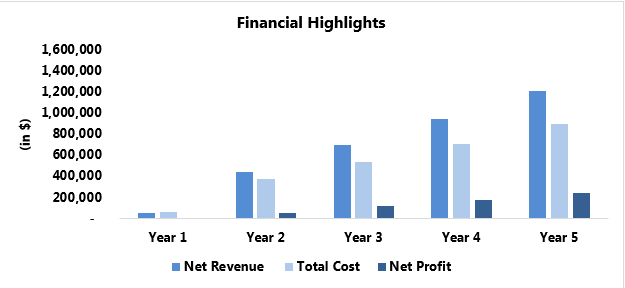

1.5 Financial Highlights