I. Executive Summary

1.1 Introduction

While it's crucial for banks to digitize their current operations, starting a new digital-only banking venture can rapidly and efficiently fulfill changing customer expectations. This is particularly true in emerging regions with rapid growth, where present offers frequently fall short of meeting client expectations. Customers usually cite poor branch customer service as a major complaint, and the functionality of digital services is constrained.

[Company Name] will be a digital financial technology platform headquartered at [insert location here] that will accentuate the necessity of creating a new, agiler culture to support the development and expansion of an internal startup by building a new digital bank with significantly cheaper capital expenditures and operating expenses per customer. The application-based platform will provide simplified up-front product offerings and more streamlined processes, such as the use of vendor-hosted solutions and selective IT investment, thus reducing the need for expensive legacy systems. This will create a more competitive market with better, lower-cost options for individuals who aren’t served well by traditional banks, driving innovation, inclusion, and access across the industry.

1.2 Founder Information

The Company will be managed and operated by [founder’s name], who has [xx] years of experience in technology and program management. He aims to leverage his professional experience and knowledge to disrupt the digital banking industry. He envisions providing highly regulated digital banking services to everyone in this world.

1.3 Target Customer – Distribution Channel

[Company Name] will primarily offer its wide range of digital banking services to large businesses, SMEs, and individuals through its application-based platform

1.4 Why Us

The Company’s offerings will be based on the three P’s, which are People, Process, and Performance. [Company Name] believes that its topmost priority is its customers, i.e., the people to whom it will serve. Its core team will comprise bright, energetic, talented, and knowledgeable professionals in order to provide the utmost digital banking services. Secondly, to support its portfolio management process, the company will leverage cutting-edge technologies like predictive behavioral analytics, data-driven marketing, automated customer service technology, and chatbots and AI interfaces to assist customers. It is also aware that the secret to successfully selling an investment product is to design a desirable product, establish a pattern of success, and demonstrate the repeatability of that pattern.

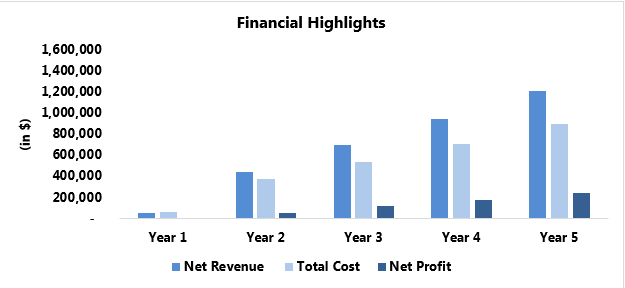

1.5 Financial Highlights