V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 has approximately 56 million verified users, 15,000 institutions, 115,000 ecosystems, and partners. Competitor 1 is a certified Bitcoin market trader that lets its clients efficiently and securely invest, spend, save, earn, and use cryptocurrency.

Its platform has the following features-

Competitor 2

Competitor 2’s wallet is built on top of the most potent technological foundation in the industry, allowing it to offer clients a comprehensive digital asset management solution that reduces risk and maximizes capital efficiency. From high-net-worth investors to leveraged traders to institutional clients, all require the highest levels of security, technology, and compliance. While collaborating with the most reputable companies in the sector and providing customers with complete crypto trading currently accessible on the market, it upholds standards like the Crypto Currency Security Standard (CCSS) and SOC2.

Competitor 3

Competitor 3 is an expanding suite of products offering complete access to all the cryptocurrencies available in the market. It has all the tools to support both novice and seasoned users in exploring and trading cryptocurrencies in a secure environment, including a web platform, a mobile app, a Chrome extension, and instructional resources. It offers transactions on all of the current cryptocurrencies, and its user-oriented dashboard shows real-time information that can assist users in making decisions while buying and selling cryptocurrencies.

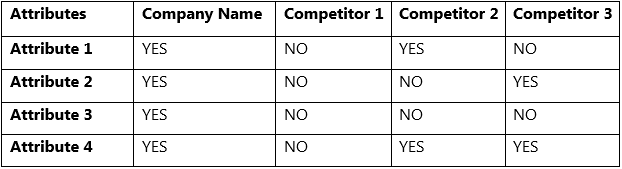

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Secure and convenient payment methods

- Available as a web platform, browser extension, and mobile application

- Users can have complete control over their data

- Founder’s extensive experience

Weakness

- Being new to the industry could lead to a significant lag in establishing goodwill and trust

Opportunities

- The global crypto asset management market is anticipated to grow at a CAGR of 21.5%, reaching $1.2 billion by 2026 from $400 million in 2021.

- An increase in the need for operational efficiency and transparency in financial payment systems and an increase in demand for remittances in developing countries are the key factors driving the growth in the global cryptocurrency market.

Threats

- Government rules and regulations

- Competitors could look to copy the company’s business model