I. Executive Summary

1.1 Introduction

The advent of connectivity, alternative models, and greater acceptance, combined with significant changes in firms' ability to access capital and a global regulatory focus on risk mitigation, have created a favorable environment for disruptors to partner with capital market firms. The role of fintech payments in capital markets has been rapidly increasing in recent years, driven by incumbent market participants' need to seek more profound insight into new technologies and alternative business models. Fintech payment solutions have revolutionized traditional payment processing methods by introducing innovative technologies that enable fast, secure, and cost-effective payment processing, providing several advantages appealing to capital market participants.

[Company Name] will develop a platform combining financial services and technology to create an ecosystem that simplifies and streamlines the investment process while reducing operational costs and providing greater efficiency and transparency. It will be a digital platform connecting investors with issuers, eliminating the need for intermediaries, thereby reducing transaction costs and providing a seamless, end-to-end solution for raising capital, trading securities, and managing investments. The Company’s FinTech Capital Market Platform will leverage cutting-edge technologies such as blockchain, artificial intelligence, and machine learning to deliver a range of financial services, including investment banking, securities trading, and asset management.

The [Company Name]'s FinTech Capital Market platform will represent a significant transformation in the financial services industry by offering new opportunities for market participants to access capital, trade securities, and manage investments more efficiently, transparently, and securely.

1.2 Founder Information

The Company will be managed and operated by [founder’s name], who has [xx] years of experience in financial technology, capital market, and regulatory compliance. He aims to leverage his professional experience and knowledge to disrupt the capital market industry via FinTech. He envisions providing a seamless and secure capital market experience to all the market participants in this world.

1.3 Target Customers

The Company will be managed and operated by [founder’s name], who has [xx] years of experience in financial technology, capital market, and regulatory compliance. He aims to leverage his professional experience and knowledge to disrupt the capital market industry via FinTech. He envisions providing a seamless and secure capital market experience to all the market participants in this world.

1.4 Why Us

Growth Potential-The fintech sector is undergoing a swift expansion, and it is anticipated that the need for fintech payment solutions in the capital markets will persistently rise in the upcoming years, resulting in a surge in demand for FinTech Payment-Capital Markets platforms.

Innovative technology – The Company’s platform is built using cutting-edge technology such as Blockchain, AI, and ML, which will offer significant advantages over traditional systems.

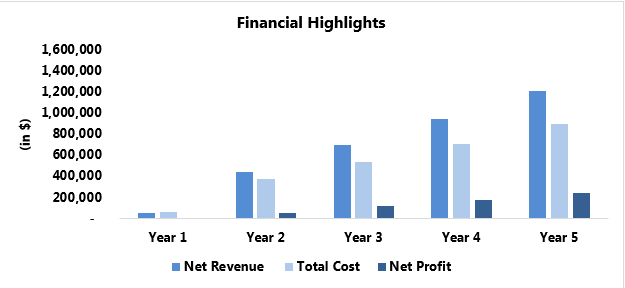

1.5 Financial Highlights