V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 is a capital market platform headquartered at [insert location]. The company was founded in [xx] by [Founder]. It finds and connects traders using the IOI(Indication of Interest)-based protocol by showing the investor’s interest in buying a bond. The company allows users to buy a wide range of exchange-traded funds and stocks.

Competitor 2

Competitor 2 is an investing platform that lets users trade stocks and ETFs alongside crypto and alternative assets. The company is a shop for traders and investors with varied trading experience, offering a range of tradable securities, advanced and user-friendly platforms, and tools to its users. The company is headquartered at [insert location], with offices across the globe.

Competitor 3

Competitor 3 is a securities trading and wealth management platform offering reporting solutions for investors and financial advisors. The trading platform provides access to trading crypto, other digital assets, indices, stocks, etc. It offers [xx] commission-free ETFs where the users can build a comprehensive and diverse collection of funds without paying fees along with buying individual stocks.

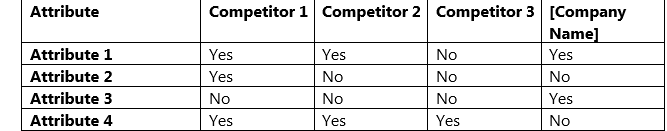

5.2 Attribute Comparison

5.3 SWOT

Strengths

- The Company’s platform will help process payments and transactions more quickly and accurately than traditional methods, allowing for faster and more efficient trades and investments.

- The FinTech Capital Market platform will reduce costs for investors and traders by eliminating intermediaries and automating processes.

- The platform will leverage cutting-edge technologies such as blockchain, AI, and ML to provide greater transparency and accountability.

Weakness

- Being new in the market can cause a significant lag in establishing goodwill and trust.

Opportunities

- With the rise of digital banking and online investment, there is a growing demand for digital financial services, including FinTech Payment Capital Market platforms.

- There is an accelerating trend of investments among the younger population, propelling the demand for investment platforms.

Threats

- As the industry continues to grow, competition may increase, leading to pricing pressures and reduced market share.

- Technological advancements can quickly become obsolete, requiring significant investments to stay competitive.