V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 is a decentralized exchange (DEX) built on the Ethereum blockchain technology that enables users to trade ERC-20 tokens without intermediaries or order books. It uses an automated market maker (AMM) system that allows users to trade tokens in a peer-to-peer manner while providing liquidity to the platform. The AMM system also uses a pricing algorithm that determines the exchange rate of tokens based on the ratio of the two tokens in a liquidity pool.

Competitor 2

Competitor 2 is a decentralized exchange (DEX) built on the Binance Smart Chain (BSC) that allows users to trade BEP-20 tokens. It uses an automated market maker (AMM) system, which means that users can trade tokens without the need for order books or intermediaries. It offers various features, including staking, yield farming, liquidity provision, and token swaps. By offering liquidity to the platform or staking their tokens, users have the opportunity to earn rewards.

Competitor 3

Competitor 3 is a decentralized exchange (DEX) that is designed to provide users with low-slippage trading for stablecoins. It was launched in [year] and operates on the Ethereum blockchain. Users are able to engage in trading several stablecoins, including USD Coin (USDC), Tether (USDT), Dai (DAI), and others. When users add funds to a liquidity pool, they receive a portion of the trading fees generated by the pool.

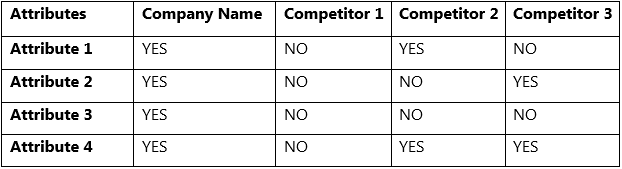

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Users can trade cryptocurrencies without having to trust a central authority with their funds.

- Because the DEXs offered by the company are decentralized, they will be less susceptible to hacking and other security breaches that can occur on centralized exchanges.

- Greater privacy for users, as they don’t need to provide personal information or undergo KYC verification.

- Greater transparency and accountability for users, which can help to build trust in the platform.

Weakness

- Being new to the sector might cause a substantial delay in building trust and goodwill.

Opportunities

- The monthly trading volume on Ethereum-based DEXs alone exceeded $50 billion in August 2021, up from less than $1 billion in January 2020, representing a 50x increase in just over a year and a half.

- Good expansion possibilities and creation of new products/services.

Threats

- The presence of low barriers to entry poses a continuous threat.