V. Competitive Analysis

5.1 Competitors

Competitor 1

[Competitor 1] is an all-in-one platform that helps customers build their digital asset business and operate as an infrastructure service provider for digital asset custody, transfer, and settlement. The company’s primary customers range from corporate institutions, exchanges, financial service companies, and brokerage and trading desks. Competitor 1 streamlines operations by bringing all exchanges, OTCs, counter-parties, hot wallets, and custodians into one platform. Wallets, deposit addresses, and API credentials are secured using chip isolation technology and cryptography (MPC).

Competitor 2

[Competitor 2] provides a platform that combines the best features of exchanges, brokerages, and instant trading apps. The platform is built around a liquidity aggregator connected to all major crypto exchanges and swap pools (centralized and decentralized), enabling users to gain the best price for their trades from a single portal. Along with powerful tools for portfolio management, it offers exceptional security, convenience, and flexibility. The platform is suitable for experienced, institutional, and newcomers.

Competitor 3

[Competitor 3] is a blockchain interface company that enables industrial tokenization in the finance, energy, mobility, and metals industries and empowers companies to manage all aspects of key generation, custody, AML, and regulatory compliance and token management. It also provides a platform to create, issue, and manage security tokens on the blockchain.

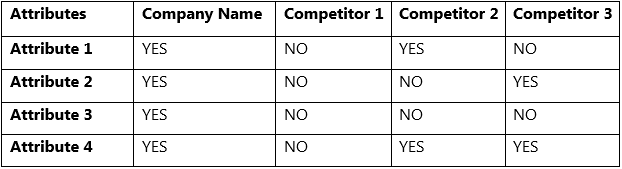

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Blockchain-enabled capital markets platform that will facilitate the creation of both digital versions of existing conventional securities and entirely new digital assets, both of which can be traded on the platform.

- By incorporating digitized securities in capital markets, the company will significantly boost the speed and volume of capital transactions.

- The blockchain-enabled platform will also speed up the issuance and payment management through direct payment between issuers and investors.

Weakness

- Being new to the industry could lead to a significant lag in establishing goodwill and trust.

Opportunities

- The North American blockchain technology market will witness market growth of 49.8% CAGR during the forecast period (2021-2027)4.

- Far-reaching benefits and the impact of blockchain technology in capital markets will enable the company to change industry mindsets.

Threats

- Competitors could look to copy the company’s business model.