I. Executive Summary

1.1 Introduction

The advent of the SaaS economy has brought about considerable modifications in accounting practices over the past few years. However, the question arises as to when a SaaS business should consider having a robust accounting system. Is it during the early stages, when they grow into an SMB or as an enterprise business? Regardless of the stage of the business, keeping track of cash inflows and outflows is crucial, making accounting an essential aspect.

[Company Name] will provide SaaS-based accounting software to the customers that will help them to maintain their business books, which creates loyalty and customer retention. Its accounting software will also have a simple user interface for the collection of data that will help businesses recognize and communicate with customers in a scalable way.

The Company will replace traditional offline software, providing organizations with a lot of flexibility as it can be accessed through any device connected to the internet, making it suitable for today's increasingly mobile-first and agile world.

The cloud-based infrastructure of SaaS accounting software offered by the company will simplify the process for both SaaS companies selling the software and businesses purchasing it. Instead of installing the software on every device, businesses can easily log in to their account online or download an application to access the company’s SaaS accounting solution.

1.2 Founder Information

[Founder's name] is a forward-thinking leader who is widely recognized for his expertise in technology, philanthropy, and business consulting. He has a wealth of experience in creating cutting-edge applications that enable businesses to enhance their customer engagement and improve employee productivity. As a trusted advisor to global business executives, he is known for his ability to drive innovation and change.

1.3 Target Customer – Distribution Channel

The target audience of SaaS accounting software includes businesses of all sizes that require an accessible and flexible accounting solution. This can include startups, small and medium-sized businesses (SMBs), as well as larger enterprises that need to manage their financial operations efficiently. The Company’s SaaS accounting software can be useful for businesses that have remote teams or multiple locations, as it allows for easy collaboration and access to financial data from anywhere with an internet connection.

1.4 Why Us

Accessibility–With the Company's SaaS accounting software, users can access their financial data from any device that is connected to the internet. This feature enables businesses with remote teams and multiple locations to conveniently retrieve their financial information from anywhere and at any time.

Scalability – The SaaS accounting software will be designed to scale as businesses grow. This means that it can handle increased amounts of data and users without the need for additional hardware or IT support.

Affordability –The Company’s software will be typically more affordable than traditional accounting software as it is based on a subscription model, which allows businesses to pay only for the features they need and use.

Customization – The software can be customized to meet the specific needs of a business. Users can choose which features they want to use and can add or remove features as their needs change.

Automation – The Company’s SaaS accounting software will automate many of the manual tasks associated with accounting, such as data entry and reconciliation, thus saving time and reducing the risk of errors.

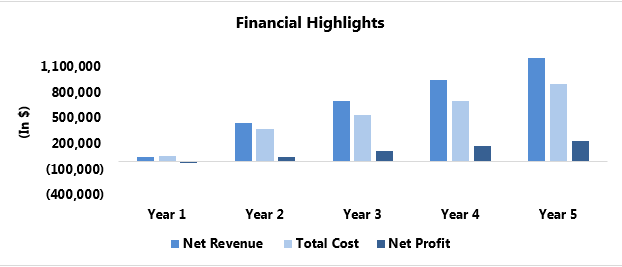

1.5 Financial Highlights