I. Executive Summary

1.1 Introduction

The financial services industry is undergoing rapid changes due to technological advancements such as mobile payments and cloud-based accounting software. This has resulted in a significant transformation in how businesses operate and engage with their customers. In addition, there has been a cultural shift in the accounting sector, with approximately 90% of accountants acknowledging that technological changes are taking place. Traditionally, accounting firms have provided compliance and advisory services to their clients. However, fintech startups are now challenging the established order and offering creative solutions that disrupt the industry.

[Company Name] will offer a fintech accounting and finance platform that will be designed to help businesses manage their financial transactions and streamline their accounting processes. The platform will leverage advanced algorithms and artificial intelligence (AI) to automate tasks that were previously done manually, such as data entry, categorization, and reconciliation, freeing up time for businesses to focus on higher-level financial tasks, saving businesses time, and reducing the likelihood of errors. The platform would integrate with other financial tools and systems, such as bank accounts, payment processors, and tax software, enabling businesses to manage all their financial transactions from a single platform, reducing the need for manual data entry and the likelihood of errors.

The Company, located at [Location Name], aims to create a fintech accounting and finance platform that will offer a range of benefits to businesses, including time savings, increased efficiency, and improved accuracy, all of which can help businesses make better financial decisions and achieve greater success.

1.2 Founder Information

The CEO of [Company Name] is a business and finance expert with a background in information technology. He has over xx years of experience working with leading global businesses. He has a track record of managing banking affairs and services. His ability to manage, plan and make decisions in a situation of crisis will undoubtedly lead to the company's success.

1.3 Target Customer

[Company Name] will majorly target accounting and finance professionals, startups, and existing and potential small and medium-sized businesses.

1.4 Why Us

- The Founder’s x years of experience, and its partnerships with some of the well-known players in the FinTech industry will give the company an advantage over its competitors.

- The Company will be solving the problem of delivering fast, highly personalized, and secure FinTech-based products /services to the end-users, that too at the minimum possible cost.

- The Company’s fintech accounting and finance platform will offer customization options allowing businesses to tailor the platform to their specific needs. This would include customizable reports, dashboards, and workflows, helping businesses get the insights they need to make informed financial decisions.

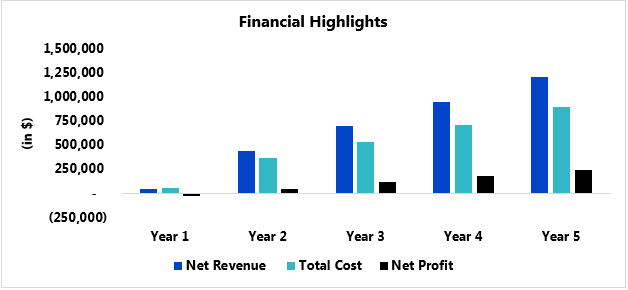

1.5 Financial Highlights