V. Competitive Analysis

5.1 Competitors

Competitor 1

[Competitor 1] provides companies with the tools and access needed for the development of a digitally-enabled financial system. It offers an infrastructure that enables customers of various banks and fintech firms to link their financial accounts to the services and apps they desire. The company offers solutions for different use cases, including personal finances, lending, wealth consulting, consumer payments, banking, and business finances.

Competitor 2

By enabling businesses to confirm consumer identities, [competitor 2] fosters confidence in online interactions and aids in account recovery, age verification, and fraud prevention. It offers a comprehensive suite of automated identity verification components with worldwide coverage that can be configured, branded, and themed to create custom-tailored flows that cover any use case. It ensures collecting, verifying, and managing complex and sensitive personal information to stay focused on building products.

Competitor 3

[Competitor 3] is a financial technology company whose fintech-as-a-service platform and open API technology allow fintechs and other commercial brands to offer financial solutions to their end users. The business provides services for virtual and physical card issuance, payment processing, and B2B payments. The company offers products and services which has use cases in different fields like neo banking, gig economy, investing, lending, consumer payments, commercial payments, wealth management, and cryptocurrency.

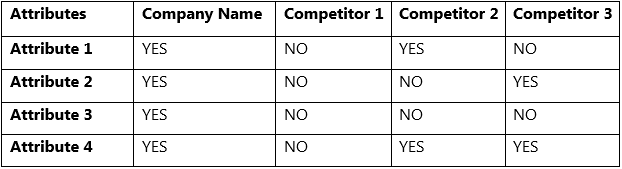

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Automate tasks that were earlier done manually, saving businesses time and reducing the likelihood of errors.

- Integrate with other financial tools and systems, such as bank accounts, payment processors, tax software, etc., enabling businesses to manage all their financial transactions from a single platform.

- Offer customization options, including customizable reports, dashboards, and workflows, which help businesses get the insights they need to make informed financial decisions.

Weakness

- To break into the targeted market, large marketing and outreach budget may be required.

- Being new in the market can cause a significant lag in establishing goodwill and trust.

Opportunities

- The global FinTech technologies market size was valued at $110.57 billion in 2020 and is projected to reach $698.48 billion by 2030, growing at a CAGR of 20.3% from 2021 to 2030.5

Threats

- The presence of existing competitors having multiple years of experience in the industry can impact the growth trajectory of the company.

- The quality of services may be affected by government regulations in each region.