V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 is an Ethereum-based decentralized NFT marketplace that facilitates the creation, purchase, and sale of digital collectibles. Additionally, it offers users the ability to utilize NFT collateral for borrowing and lending purposes. This platform serves as a hub for artists, creators, and collectors, providing them with an avenue to actively participate in the NFT ecosystem.

Competitor 2

Competitor 2 is a platform that focuses on digital art and collectible NFTs. It provides a marketplace where users can buy, sell, and discover NFTs created by artists and creators. The platform supports fiat currency transactions, allowing users to purchase NFTs directly with credit cards or bank transfers. This feature simplifies the process for users who are not familiar with cryptocurrencies.

Competitor 3

Competitor 3 is an Ethereum-based platform that synergizes decentralized finance (DeFi) and non-fungible tokens (NFTs). By leveraging the company's protocol, a decentralized lending and borrowing platform, it creates a seamless integration. Moreover, the company incorporates play-to-earn dynamics, enabling users to engage in a range of mini-games, quests, and challenges to earn rewards and tokens.

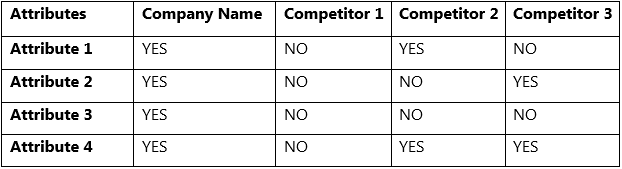

5.2 Attribute Comparison

5.3 SWOT

Strengths

- The Company's lending/borrowing platform is highly cost-efficient compared to other platforms, charging only 1% of the asset value for facilitating borrowing/lending.

- The organization offers a unique and innovative marketplace for NFT collateral loans, providing a differentiated service in the market.

- The organization provides a vibrant and inclusive marketplace that connects collectors and enthusiasts with a diverse range of high-quality NFT assets.

Weakness

- Being new to the industry could lead to a significant lag in establishing goodwill and trust.

- The Company's success is closely tied to the growth and adoption of the NFT market. If the NFT market experiences a decline or faces regulatory challenges, it could impact the organization's performance.

Opportunities

- As the NFT market matures, the demand for NFT collateral loans is expected to rise. The organization can leverage this trend to attract borrowers and lenders seeking capital and liquidity.

- The NFT market is rapidly expanding, presenting significant opportunities for the organization to capture market share and establish itself as a leading NFT finance platform.

Threats

- Competitors could look to copy the company’s business model.

- Regulatory changes or uncertainties surrounding NFTs and decentralized finance could pose risks and challenges to the organization's operations.