V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 RegTech company that provides real-time financial crime detection and prevention solutions. The company uses AI and machine learning to help its clients comply with AML (Anti-Money Laundering), CTF (Counter-Terrorist Financing), and other regulations related to financial crime. The company’s solutions are used by a wide range of financial institutions, including banks, fintech companies, and cryptocurrency exchanges.

Competitor 2

Competitor 2 identity verification company that provides digital identity and business verification services. Its platform enables businesses to verify identities online in real-time, using a range of data sources, including government databases, credit bureaus, and social networks. The company's solutions help businesses comply with global anti-money laundering (AML) and know-your-customer (KYC) regulations, as well as fraud prevention and identity verification requirements. Its clients include financial institutions, payment providers, online marketplaces, and other businesses that require identity verification services.

Competitor 3

Competitor 3 is a provider of client lifecycle management (CLM) software solutions for financial institutions. Its platform enables banks to manage regulatory compliance and client data across multiple jurisdictions and business lines. The company's solutions cover onboarding, regulatory compliance, data management, and client lifecycle management. Its software helps financial institutions to comply with regulatory requirements such as anti-money laundering (AML), know-your-customer (KYC), and tax compliance.

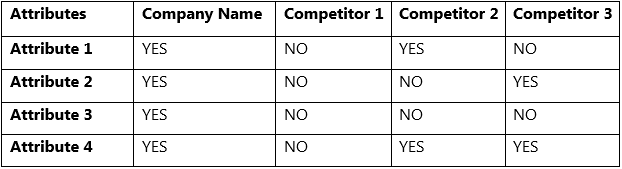

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Enable businesses to identify and mitigate compliance risks in real-time, reducing the risk of regulatory fines and reputational damage.

- Manage large amounts of data efficiently and securely, minimizing unauthorized access or data loss and improving data governance.

- Automate compliance processes, reducing the risk of human error and ensuring that businesses are in compliance with regulatory requirements as well as reducing the time and cost required for compliance.

Weakness

- A large marketing and outreach budget may be required to break into the targeted market.

- Being new to the market can cause a significant lag in establishing goodwill and trust.

Opportunities

- The Global RegTech market size was valued at $15.68 billion in 2020 and is projected to reach $87.17 billion by 2028, growing at a CAGR of 23.92% from 2021 to 2028.5

- The increasing occurrence of fraudulent activities across the internet leading to financial losses is providing a thrust to the market growth.

Threats

- There are already established market participants in the business.

- Competitors could look to copy the company’s business model