V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 is a unified portfolio for the cryptocurrency market and tries to connect its customers to every custody solution and liquidity provider to enable seamless portfolio management. It is a robust platform enabling its users to connect to their favorite exchanges and wallets. Competitor 1 adapts ideas from smart investors outside of crypto to introduce simple automated strategies which can help decrease risk and increase returns. It also allows the users to separate accounts into multiple virtual portfolios.

Competitor 2

Competitor 2 is the accounting, tracking, and tax optimization tool for Bitcoin and other cryptocurrencies. It is a team of aflame blockchain investors and believers that have moved to form the foremost comprehensive and simple-to-use taxes and pursuit tool within the blockchain space. It provides two features to its customers in the form of a crypto tax calculator and a crypto tracker. With the help of these two features, customers can get an entire overview of their portfolio and automatically classify and calculate crypto taxes.

Competitor 3

Competitor 3 is a portfolio tracker and wealth management company. It is an all-in-one portfolio tracker and wealth management platform for modern life. It is as simple as a spreadsheet and as powerful as institutional tools. It also allows sharing a read-only link of your portfolio with others – like with Investment Advisor, CP, etc.

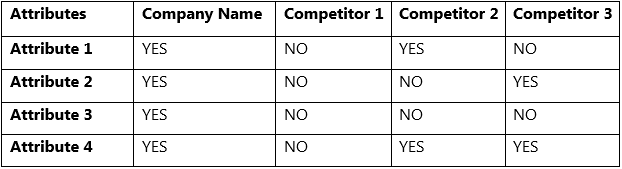

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Quality service at a very competitive price will make the company a go-to-option for its target market

- Customization as per the needs of the customers

- No data loss as the platform works anonymously and is highly encrypted

- Founder’s extensive experience

Weakness

- A large marketing and outreach budget may be required to break into the targeted market.

- Being new to the market can cause a significant lag in establishing goodwill and trust.

Opportunities

- The global crypto asset management market is anticipated to expand from $0.4 billion in 2021 to $1.2 billion by 2026, exhibiting a compound annual growth rate (CAGR) of 21.5% during the projected period.[ ]

- The growing implementation of advanced technologies such as artificial intelligence, the Internet of Things, connected devices, and big data are expected to fuel the software's demand.

Threats

- The industry already has established players in the market.

- Competitors could look to copy the company’s business model