V. Competitive Analysis

5.1 Competitors

Competitor 1

Competitor 1 provides a gateway for cryptocurrency mining using radio waves. The company mines tokens by validating that other gateways in the network are providing wireless connectivity. Connects low-powered machines to a single gateway and sends encrypted data through to the internet. Every time machines connect to the gateways, and owners are rewarded with tokens.

Competitor 2

Competitor 2 provides cryptocurrency mining software that was developed to provide an effortless way to mine alternative currencies. Given the versatility of the platform, those who may have no prior experience are just as welcome as those who are mining experts. Courtesy of the multi-algorithm cloud mining, it is perfect for beginners as well as for anyone who cannot take their mining to a new level.

Competitor 3

Competitor 3 is a manufacturer of blockchain, cloud-based ASICs for crypto mining applications. It develops and sells ASICs, PCBs, boards, servers, and data centers for mining Bitcoin. It features blockchain as a service for government integration, a crypto payment portfolio, blockchain-based solutions for the music industry, and a web-based software tool for law enforcement of blockchain applications.

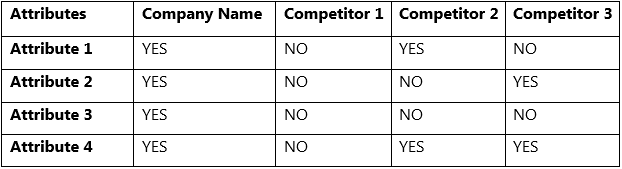

5.2 Attribute Comparison

5.3 SWOT

Strengths

- Offering specialized hardware and software to maximize the computing power and efficiency of cryptocurrencies, leading to faster and more effective mining

- Prioritizing energy efficiency and sustainability to appeal to environmentally-conscious investors and customers

- Mining multiple cryptocurrencies to reduce risk and maximize profitability

- High level of security and reliability to prevent fraud, hacking, and other risks

Weakness

- Being new to the industry could lead to a significant lag in establishing goodwill and trust

Opportunities

- The global cryptocurrency mining market is anticipated to reach $1.61 billion by 2025, from $888.2 million in 2019, with a CAGR of 16.1% from 2020 to 2025.

- The global cryptocurrency market is driven by the increasing demand for operational efficiency and transparency in financial payment systems and the growing need for remittances in developing nations.

Threats

- Government rules and regulations

- Competitors could look to copy the company’s business model